Get the free loan summary to printable form

Show details

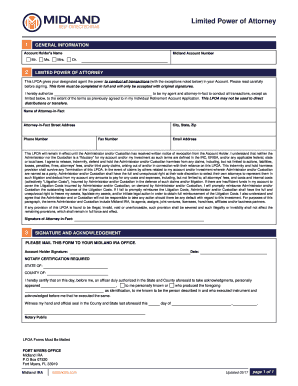

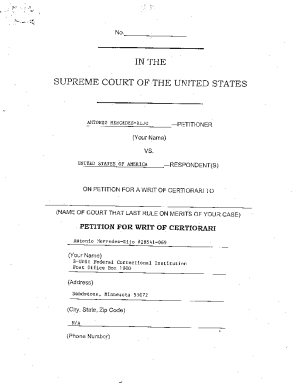

VA LOAN SUMMARY SHEET 1. VA'S 12-DIGIT LOAN NUMBER 2. VETERAN'S NAME (First, middle, last) 3. VETERAN'S SOCIAL SECURITY NUMBER 6A. ETHNICITY NOT HISPANIC OR LATINO HISPANIC OR LATINO 4. GENDER OF

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign

Edit your loan summary to printable form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your loan summary to printable form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit loan summary to printable online

To use our professional PDF editor, follow these steps:

1

Create an account. Begin by choosing Start Free Trial and, if you are a new user, establish a profile.

2

Simply add a document. Select Add New from your Dashboard and import a file into the system by uploading it from your device or importing it via the cloud, online, or internal mail. Then click Begin editing.

3

Edit loan summary sheet form. Text may be added and replaced, new objects can be included, pages can be rearranged, watermarks and page numbers can be added, and so on. When you're done editing, click Done and then go to the Documents tab to combine, divide, lock, or unlock the file.

4

Save your file. Choose it from the list of records. Then, shift the pointer to the right toolbar and select one of the several exporting methods: save it in multiple formats, download it as a PDF, email it, or save it to the cloud.

pdfFiller makes dealing with documents a breeze. Create an account to find out!

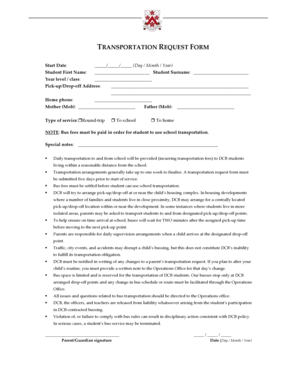

How to fill out loan summary to printable

How to fill out a loan summary to printable:

01

Gather all necessary information and documents related to the loan, including loan agreement, repayment schedule, interest rates, and any supporting documents.

02

Review the loan agreement and understand its terms and conditions.

03

Organize the information in a clear and logical manner, ensuring all relevant details are included.

04

Create or find a template for a loan summary that suits your needs. You can use word processing software or online templates.

05

Start by adding a header with the title "Loan Summary" and include the borrower's name and contact information.

06

Provide a brief introduction stating the purpose of the loan and any important dates.

07

Divide the loan summary into sections, such as loan details, repayment schedule, and interest calculations.

08

In the loan details section, include information about the lender, loan amount, interest rate, loan term, and any other relevant details.

09

In the repayment schedule section, list the due dates, amounts, and payment methods for each installment.

10

If applicable, include any additional fees, penalties, or charges associated with the loan.

11

Use tables, bullet points, or numbered lists to present the information clearly and concisely.

12

Review the loan summary for accuracy and completeness, making any necessary revisions.

13

Save the loan summary as a printable file format, such as PDF, to ensure it can be easily accessed and printed.

Who needs loan summary to printable?

01

Loan applicants who want to have a physical copy of their loan summary for their records.

02

Lenders who require a printable loan summary to provide to their clients or for internal documentation.

03

Financial advisors or consultants who need to analyze and review loan summaries as part of their work.

Fill form : Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is loan summary to printable?

A loan summary to printable refers to a document or a report that provides a concise overview of the key details and terms of a loan, which can be easily printed for reference or documentation purposes. It usually includes information such as the loan amount, interest rate, repayment term, monthly payment amount, and any additional fees or charges associated with the loan. The loan summary aims to provide a clear and comprehensive snapshot of the loan agreement in a printed format for the borrower's convenience.

Who is required to file loan summary to printable?

The responsibility of filing a loan summary to printable usually falls on the lender or financial institution that provided the loan. They may be required to generate and provide a printable loan summary to the borrower for record-keeping purposes or as part of regulatory requirements. The borrower may also request a printable loan summary for their own reference or when applying for certain financial services.

How to fill out loan summary to printable?

To fill out a loan summary to printable, you can follow these steps:

1. Open a word processing or spreadsheet software on your computer, such as Microsoft Word or Excel.

2. Create a table with the necessary columns and rows to include all the relevant information of the loan. Some common columns include:

- Loan amount

- Interest rate

- Loan term

- Monthly payment

- Total interest paid

- Total repayment amount

3. Enter the data provided for each column in the appropriate cells of the table. Make sure to double-check the accuracy of the information.

4. Format the table as needed to make it visually appealing and easy to read. You can adjust the column widths, change the font style, and apply different formatting options.

5. Add any additional details or notes that may be important, such as prepayment penalties or any special terms and conditions associated with the loan agreement.

6. Review the summary for any errors or omissions. Ensure that all the necessary information has been included.

7. Save the document in a printable format, such as PDF or Word (if using a word processing software). This will allow you to easily print or share the loan summary.

8. Print the document using a printer connected to your computer. Make sure to select the appropriate settings, such as paper size and orientation, before printing.

Alternatively, if you don't want to create a custom layout, you can search for loan summary templates online. These templates often come in downloadable, printable formats, which you can fill in with your loan details using a word processing software.

What is the purpose of loan summary to printable?

The purpose of a loan summary to printable is to provide a concise and easily readable document that outlines the key information related to a loan. This summary is typically created in a printable format for convenience and ease of reference. It includes details such as the loan amount, interest rate, repayment terms, and other important information regarding the loan agreement. This document is used by borrowers as a reference tool to keep track of their loan obligations and to have a clear understanding of the terms and conditions of their loan. It may also be required by lenders or financial institutions as part of their documentation and record-keeping processes.

What information must be reported on loan summary to printable?

The information that must be reported on a loan summary to printable include:

1. Borrower's information: This includes the borrower's name, contact details, and any other relevant identification information.

2. Loan details: This includes the loan amount, interest rate, terms, and repayment schedule. It should also mention if the loan is secured or unsecured.

3. Loan application details: This includes the date of loan application, the purpose of the loan, and any supporting documents or requirements.

4. Loan status: This includes the current status of the loan, whether it is approved, pending, or denied.

5. Payment history: This includes a breakdown of the borrower's repayment history, including the dates and amounts of each payment made.

6. Outstanding balance: This includes the current outstanding balance of the loan, including any late fees or penalties.

7. Contact information: This includes the contact details of the lender or lending institution, including their name, address, phone number, and website.

8. Additional terms and conditions: This includes any additional terms or conditions that are specific to the loan, such as prepayment penalties or early repayment options.

9. Disclosures: This includes any necessary legal disclosures, such as information about the Annual Percentage Rate (APR), any fees or charges associated with the loan, and any relevant consumer protection notices.

It is important to note that the specific information required on a loan summary may vary depending on the jurisdiction and the type of loan being offered. It is always advisable to consult with legal and financial professionals to ensure compliance with relevant laws and regulations.

What is the penalty for the late filing of loan summary to printable?

It is unclear what is meant by "loan summary to printable." If you are referring to a loan summary report that needs to be printed or submitted, the penalty for late filing would typically depend on the specific rules and regulations of the institution or organization requiring the report.

In general, late filing penalties may include financial penalties or fees, interest charges, restrictions or limitations on future loans, or negative impacts on credit scores. It is best to consult the specific guidelines or contact the relevant institution or organization to obtain accurate information regarding late filing penalties.

How can I send loan summary to printable to be eSigned by others?

When your loan summary sheet form is finished, send it to recipients securely and gather eSignatures with pdfFiller. You may email, text, fax, mail, or notarize a PDF straight from your account. Create an account today to test it.

How do I complete 26 0286 online?

pdfFiller makes it easy to finish and sign what is mcrv number on va loan summary online. It lets you make changes to original PDF content, highlight, black out, erase, and write text anywhere on a page, legally eSign your form, and more, all from one place. Create a free account and use the web to keep track of professional documents.

How can I edit amazon on a smartphone?

The pdfFiller mobile applications for iOS and Android are the easiest way to edit documents on the go. You may get them from the Apple Store and Google Play. More info about the applications here. Install and log in to edit va loan summary sheet form.

Fill out your loan summary to printable online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

26 0286 is not the form you're looking for?Search for another form here.

Keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.